rsu tax rate uk

How Are Rsu Taxed In Uk. Since the price of the vested stock is 10 and you own 100 shares the total value of your stock is 1000.

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

The rsus are subject to ni and income tax at your marginal rate on their value at the time they vestyou can either choose to pay the tax yourself and receive all the sharesbut most people will opt to have shares deducted to pay for these deductionsso if you are a higher rate tax payer you will be due to pay 42 tax and ni which would mean your.

. The Sell-To-Cover Method Explained. Tax Implications of Restricted Stock Units. If the employee received the RSU for free the employment tax charge would be 80.

Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock. RSUs are not taxable when they are granted. Vesting after Social Security max.

If you already earn in excess of this and the RSUs take you over 150000 you will pay 45 income tax plus the employers National Insurance. The grant of RSUs does not incur any tax dueRSUs are taxed the same way as your salary in the UK When they vest you only pay tax on themUpon retiring to a companys tax shelter your employee national insurance will be deducted from your income. De RSUs Restricted Stock Units.

Restricted Stock Units RSUs Tax Calculator Apr 23 2019 0 Hope you had a chance to glance over at the official Restricted Stock Unit RSU Strategy. The payment of a cash equivalent to securities. Most employers will withhold taxes on your RSUs at a rate of 22 but you could easily be in a higher tax bracket than that.

Check out our new Podcast EpisodeVideo. You pay no CGT on the first 12300 that you make. On the restriction lifting the share is now worth 200.

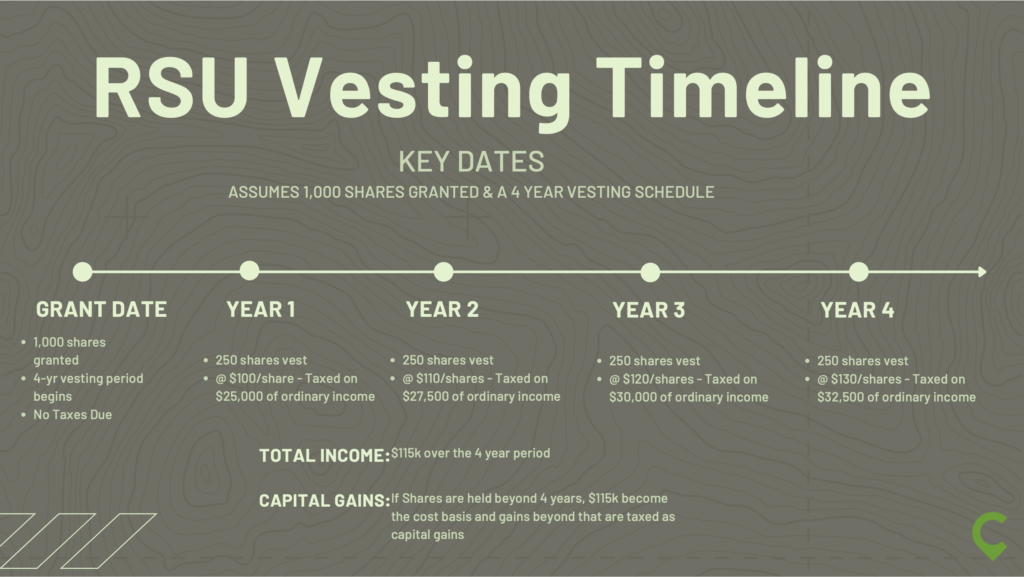

- This is an important output as it will tell you if there is a chance your employer didnt withhold enough taxes for you as your RSUs vested. This happens over time through a vesting schedule. At any rate RSUs are seen as supplemental income.

Whatever the rate at which RSUs are viewed they are considered. This method allows the employer to sell just enough of your vested RSUs to cover the tax burden and distribute the remaining shares to the employee. 22 for federal taxes 37 if total income is more than 1million Social Security and Medicare and Some amount for state income taxes if you live in a state that has an income tax.

Vesting after making over 137700. You will be subject to capital gains tax at a flat rate of currently 18 when you subsequently sell any shares acquired at vesting of the restricted stock units at a gain. The stock is restricted because it is subject to certain conditions.

The employee is subject to a flat tax of 15 percent on any net gain resulting from the sale of the shares by Argentine Tax residents or alternatively 135 percent on the gross sale price by non-residents. If the employee is a basic-rate taxpayer the income tax charged would be 6 12 20 or 40 of 30 depending on the tax status of the employee. Employers will usually deal with this under PAYE and so if you are the recipient of some RSUs initially there is nothing you need to do to make that happen.

50 Tax and NIC paid Employee total salary before RSU is 100000 Salary 100000 RSU Value 25000 RSU Value 25000 Deducting employers NIC 138 3450 Remaining 21550 Income tax 40 of Remaining 8620 Extra tax of 4310 due to loss of personal allowance as income above 100000 Employee NIC 2 431. Many employers though make it far less convenient for the employee by withholding on supplemental income like RSUs and bonuses at a flat rate which includes. Assuming a 35 Federal tax rate your total tax bill on these shares is 17500.

Vesting after Medicare Surtax max. Most companies will withhold federal income taxes at a flat rate of 22. Plan For the RSU Vesting Event.

At this point the employee is charged to income tax on 30. A app to help calculate how much tax you pay on RSUs. For every 2 you earn above 100000 your Personal Allowance is reduced by 1.

Want more RSU info. Because the RSUs pushes your total income above 100000 you will pay 60 income tax on the RSUs. RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them.

How Much Tax Do You Pay On RsuS. In some states such as California the total tax withholding on your RSU is around 40. Its is a considerable sum especially as it was taxed at 45 plus NI while I presently have only a minimal income and no NI to pay though this is income so will likely be lifting to.

Vesting after making over 200k single 250k jointly. 25 of these shares 1000 vest in June of 2022. You pay 1286 at 20 tax rate on the remaining 6430 of your capital.

If the RSUs take you over 100000 you will pay income tax at a marginal rate of 60 plus the employers National Insurance. You will be taxed on the difference between the sale proceeds and the fair market value of the shares at vesting. The value of over 1 million will be taxed at 37.

4000 RSU shares were granted in June 2021. In this method the employee is left with stock. For one a recipient cannot sell or otherwise transfer ownership of the stock to another person until the restrictions lift.

Restricted stock and RSUs are taxed upon delivery and subject to progressive income tax up to 56 percent. Capital gains tax CGT breakdown. Most companies will withhold federal income taxes at a flat rate of 22.

You can use the 2020 brackets below to estimate your tax bracket Marginal State Tax Rate. The share price is 5 0 on the vesting date this becomes your cost basis if holding the shares You owe taxes on 5 0000 of RSU income for 2022. Restricted stock is a stock typically given to an executive of a company.

RSUs that provide securities on vesting Until 5 April 2016 normally the securities would be taxed as. The first time that they are exposed to tax is upon vesting at which time both income tax and NIC are due. You pay 127 at 10 tax rate for the next 1270 of your capital gains.

The employee is taxed on restricted stock upon grant and on RSUs upon vesting may include personal assets tax. In your case where your capital gains from shares were 20000 and your total annual earnings were 69000. This is known as the 60 tax trap.

For academic purposes only. This doesnt include state income Social Security or Medicare tax withholding. RSUs can trigger capital gains tax but only if the stock holder chooses to not sell the stock and it increases.

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

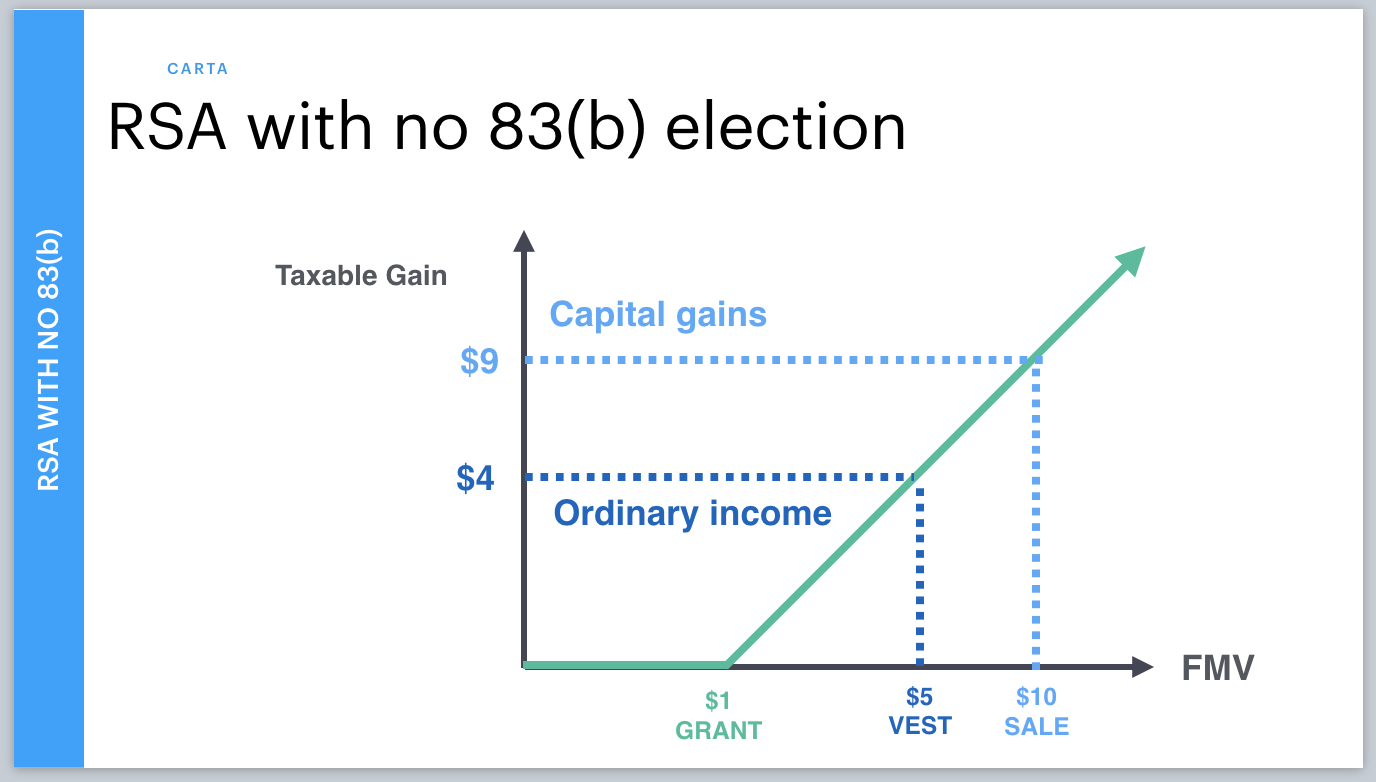

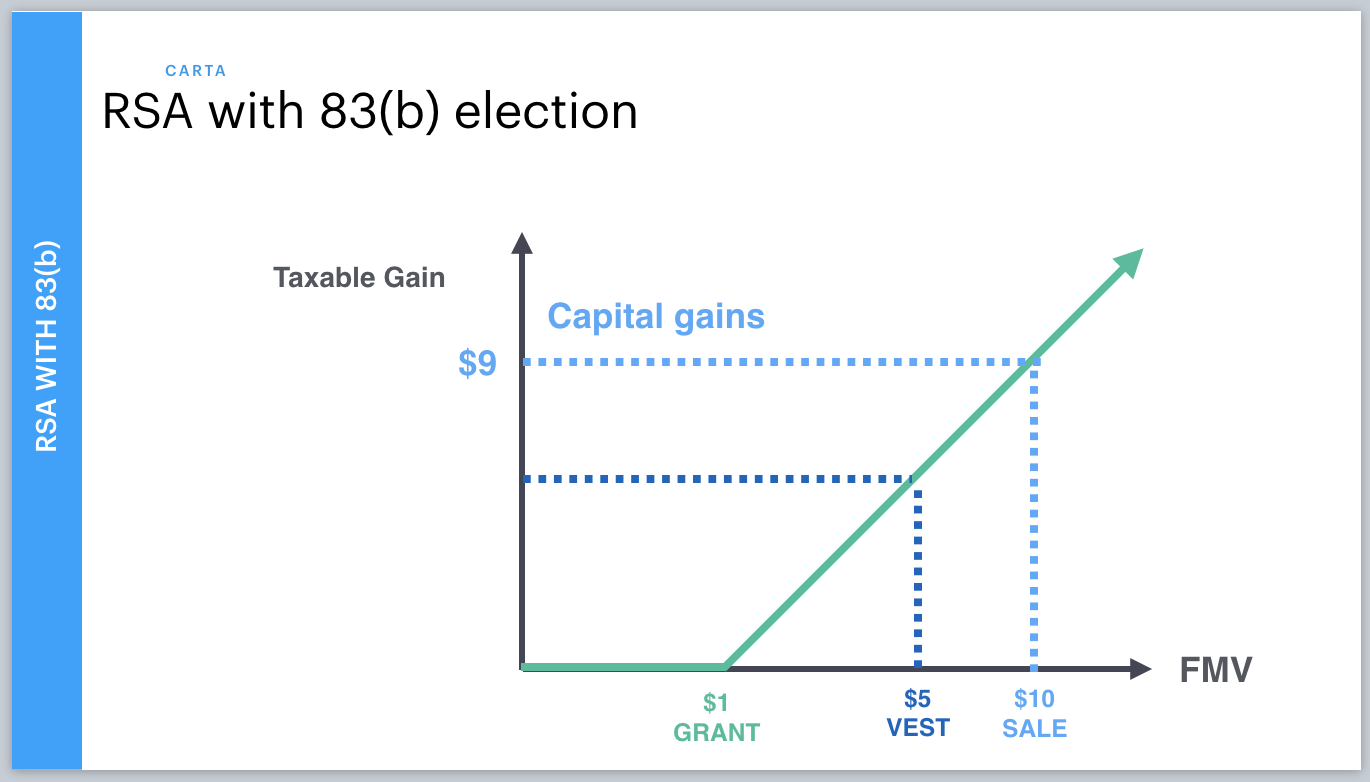

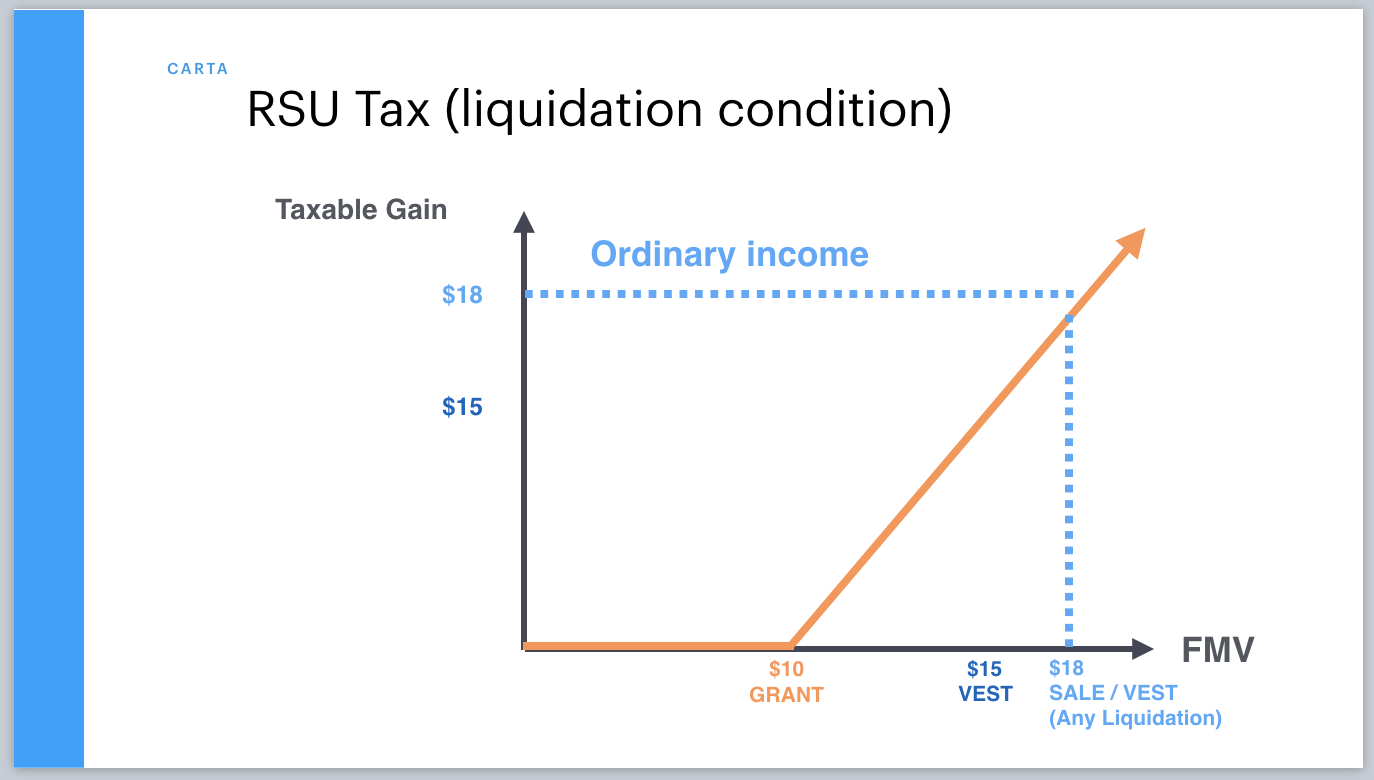

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

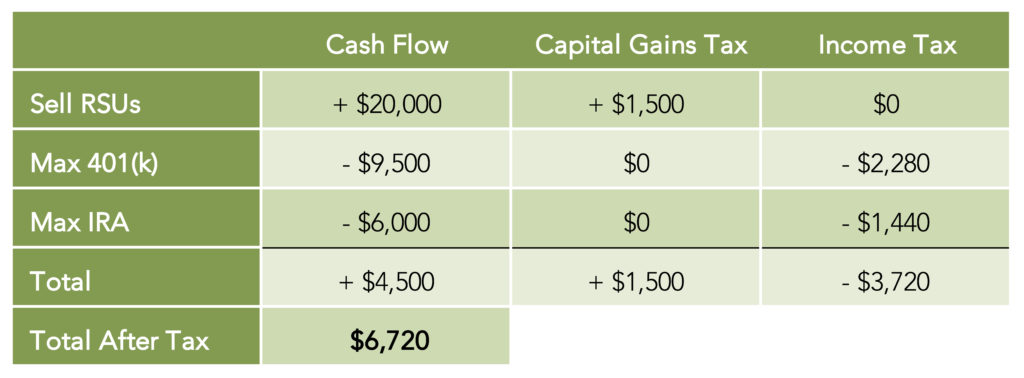

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

A Tech Employee S Guide To Rsus Cordant Wealth Partners

Don T Pay Tax Twice On Rsu Sales Parkworth Wealth Management

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta